MBBS in Georgia has become a popular choice among Indian students who wish to pursue MBBS abroad at a small and affordable tuition fee, English medium and Medical education provided. But even spreading costs over six years can still be a financial strain for many families. Here’s where an education loan for MBBS in Georgia comes as a feasible and secure option.

To assist you with better planning, here is a complete guide from loan eligibility to loan amount and interest rates; repayment terms and banks offering education loans for students who wish to study MBBS in Georgia will draw your attention.

Is an Education Loan Available for MBBS in Georgia?

Yes. There are banks in India and NBFCs which offer education loans for MBBS abroad, including Georgia, if the university is recognised by NMC / WDOMS and the student satisfies their eligibility.

The majority of Georgian medical universities adhere to international recognition standards and are acceptable to Indian lenders.

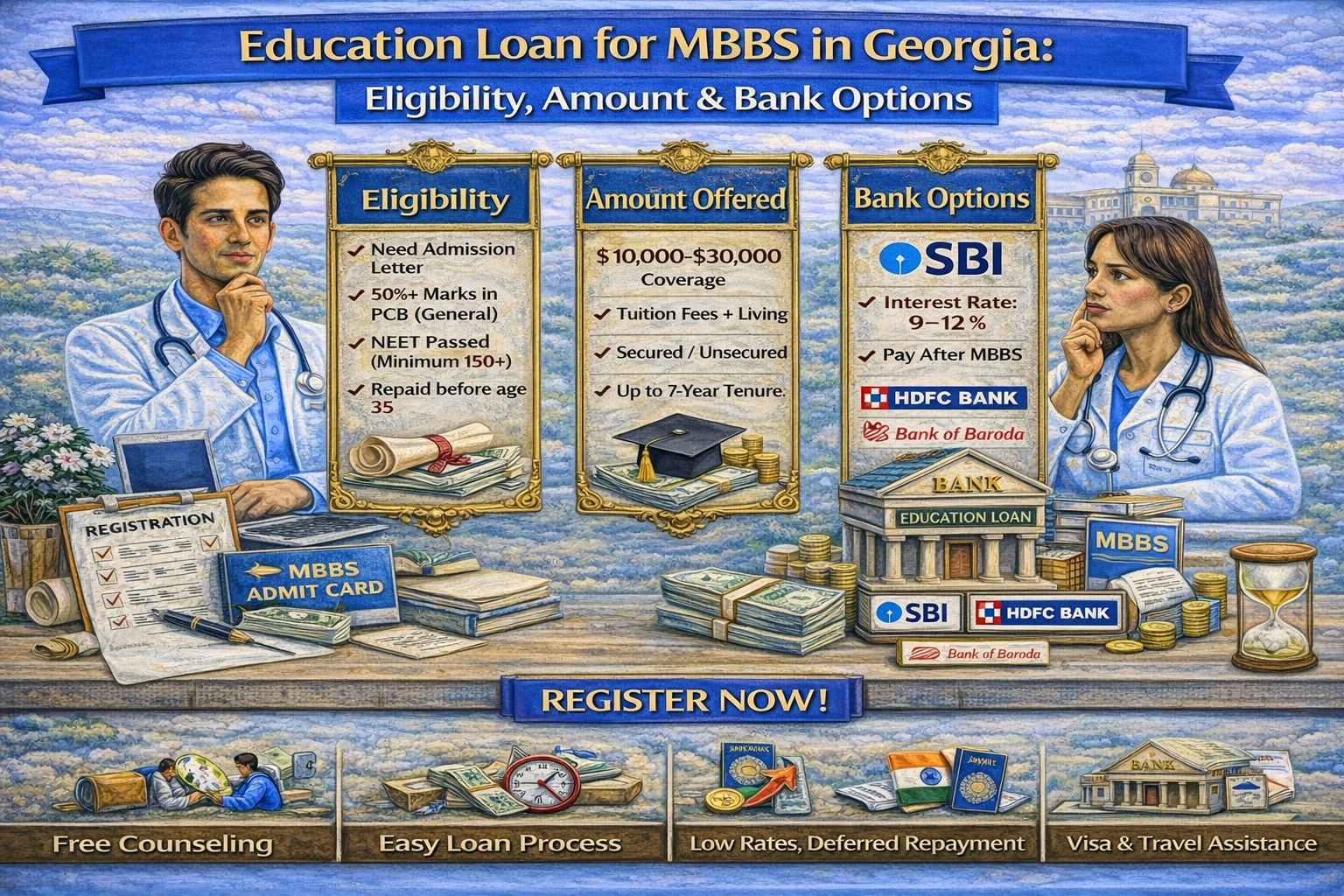

Compulsory Eligibility Requirement for Education Loan

To get an education loan for MBBS in Georgia, you should fulfil the following criteria:

Student Eligibility

- Must be an Indian citizen

- Eligible NEET UG (must for MBBS abroad)

- Admission to a Georgian Medical College on an approved status

- Age generally between 17 and 25 years

Co-Applicant (Parent/Guardian) Requirements

- Stable income source

- Good credit history (CIBIL score preferred: 700+)

- Proof of income, ITR or salary slips

NEET certification is important as banks cross-check with NMC norms before the loan application gets sanctioned.

Study Loan Amount for MBBS in Georgia

The value of the loan is determined by whether it is secured or unsecured.

Unsecured Education Loan

- Loan amount: Rs.7.5 lakh to Rs.40 lakh

- No collateral required

- Higher interest rates

Secured Education Loan

- Loan amount: Up to ₹1 crore or even higher

- Requires collateral (property, FD, insurance)

- Lower interest rates

- The loan can cover:

- Tuition fees

- Hostel/accommodation charges

- Food & living expenses

- Medical insurance

- Books & study materials

- Travel & visa costs

Interest Rates on Education Loan

Interest rates depend on the type of lender and on security.

Typical Interest Rate Range

- Public sector banks: 8.5 – 10.5 %

- Private banks: 10% – 13%

- NBFCs: 11% – 14%

Girl students may get a concession of 0.25% to 0.50% in certain banks.

Repayment Period & Moratorium

Study loans have the flexibility of repayment.

Moratorium Period

Course duration (6 years)

6–12 months following course completion

Repayment Tenure

15 years after the moratorium

This will enable students to begin repaying after they complete their MBBS and get a job or clear the licensing exams.

Documents Required for Education Loan

Student Documents

Admission letter from Georgian University

NEET scorecard

- Passport & visa

- Academic certificates (10th & 12th)

Co-Applicant Documents

- ID & address proof

- Proof of income / Salary slips / ITR

- Bank statements

- Property documents (for secured loans)

Top Banks Providing Education Loan for MBBS in Georgia

Public Sector Banks

- State Bank of India (SBI)

- Bank of Baroda

- Punjab National Bank

- Union Bank of India

Private Banks

- ICICI Bank

- Axis Bank

- HDFC Credila

NBFCs

- Avanse

- Auxilo

- InCred

Public banks are preferable if one is looking for lower interest rates, whereas processing is quicker with higher unsecured limits to be found in the case of NBFCs.

Loan Processing Time

- Public banks: 20–30 working days

- Private banks/NBFCs: 7–15 working days

In addition, it is faster to apply early and prevent delays in paying fees and getting your visa.

Tax Benefits on Education Loan

According to Section 80E of the Income Tax Act, interests on education loans are tax-deductible for a maximum period of 8 years, offering significant tax benefits for parents or students.

15 Easy Steps to Get an Educational Loan Approved

- Choose NMC-recognised universities

- The co-applicant must have a good CIBIL score

- Apply with complete documentation

- Go for a secured loan wherever possible

- Submit with ample time (at least 2–3 months prior to admission)

Conclusion

Study loan for MBBS in Georgia enables Indian students to avail quality education while taking the financial load off their families at the beginning, thereby making it easier for them to support their child’s dream. Loan amount 1 crore, Minimum processing fee, Multiple bank options, Longer tenure of repayment. Now you can easily fund your medical education.

With the right lender, early planning and eligibility selection, students would be able to make their MBBS trip to Georgia hassle-free and concentrate solely on their medical career.